Student Loan Debt: Understanding the Numbers

“Education is the way out of the poverty trap. It shouldn’t be the poverty trap itself and make those trying to better themselves incur massive student debt.”

There is tremendous discussion taking place around higher education (actually, this has been going on for decades). This includes everything from states that are attempting to control policy around the academy through new tenure rules, challenging (and outlawing) DEI initiatives, and even opinions around the value of college and the ROI on a college degree.

There’s no doubt that the cost of college is one of the key considerations for many students (and families) thinking about post-secondary education. But should the discussion be centered around the price tag of a degree or should it be on the value of a degree? Well, like most things it’s complicated with not just one simple answer and ideally the conversation around higher education will take into account both price tag and value.

Affordability is a major consideration that hasn’t escaped any corners of our society. Recently, Roy Moore did a bit on The Daily Show taking on the modern day cost of college. I’m a big fan of the show but we definitely need more than a nine minute bit to help us understand the complexities around the cost and value of college.

This post is to dive into some of the numbers around student debt. Sometimes we really can’t understand the numbers and what they mean without breaking them down. So, with that in mind I will help explain objective numbers associated with federal direct loans, the most common type of loan taken out by college students.

The graph below shows the average cumulative federal loan amount for students who completed a degree or certificate and received federal loans. Now, keep in mind that there are thousands of students who never completed a credential yet have considerable debt. This is a less-than-ideal situation. But utilizing the information from the graph I’m going to focus on students who did complete a credential, specifically a bachelor’s degree. Note that the process I go through below may be applied to any of the loan amounts for certificates or associate’s degrees.

According to data from the National Center for Education Statistics, a student graduating from public IHE will have an average of $26,100 of federal loan debt and a student graduating from a private, non-profit IHE will have on average $29,000 of federal loan debt. Now, is that a lot of debt? I feel that’s a value judgment where some will say that no one should have to take on any debt for a degree and others view these amounts as well worth it.

I’m not going to weigh in with my opinion, but rather let’s look at the numbers in an objective way to understand what this debt means after graduation.

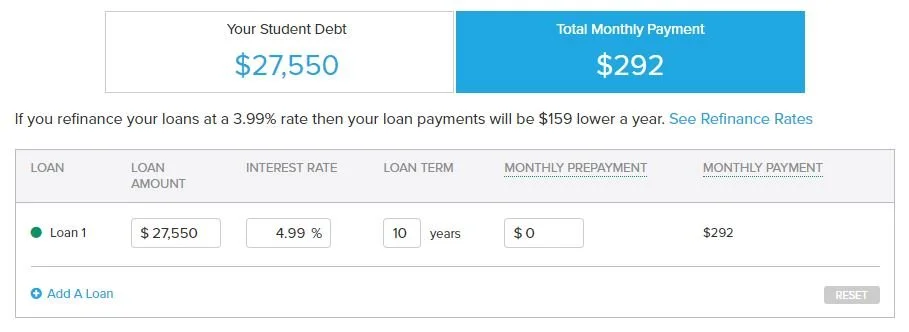

First, let’s average the two numbers to come up with a single debt amount ($26,100+$29,000)/2 = $27,550. I know pure statisticians will reprimand me for doing this but please bear with me and understand that this is to make a point and not to prove a point.

As with all loans, in order to truly understand the cost we need two more pieces of information - interest rate and payback length.

Let’s start with the interest rate. The table below from Federal Student Aid shows the current interest rates on federal direct loans.

So let’s assume that the average student loan debt we determined above was all taken at the same interest rate of 4.99%. Again, this is an assumption I’m making for this post and certainly is not a given that any student should make as the interest rate for any financial aid package could be different. In other words, the loan you take out for your first year could be at a different interest rate than the loan you take out for your sophomore year, and so on.

Now that we know the assumed interest rate, we need to know the length of the loan. Well, the feds make this relatively easy for us. Although there are different loan payback plans, the standard and default plan is based on a payback period of 10 years.

So, now that we know three critical pieces of information - loan amount, interest rate, and payback period - we can figure out how much our monthly debt load is.

There are many loan debt calculators out there, but one of my favorites is this one from Smartasset. So, using our information as follows…

Loan amount - $27,550

Interest rate - 4.99%

Payback period - 10 years (120 months)

…take 60 seconds to think through these numbers yourself - can you estimate how much this will be each month?

Let’s see what the calculator tells us.

The calculator tells us that we will pay $292 every month for the next ten years. But, again, as with all loans this is just part of the story. Let’s figure out how much you will actually pay for that loan. In other words, the principal of $27,550 will actually be how much when all is said and done?

Well, let’s return to the handy calculator and find that the total of this loan is actually $35,049. In other words, on a principal amount of $27,550 the actual amount paid over 10 years is actually 27% more.

Many graduates switch from the standard payment length and decide to pay their debt over a longer term. How does this change the monthly and total payment amounts?

Monthly Amounts in Dollars Based on Debt Loan Length

Total Loan Amount Based on Payback Length

So to be clear, as you extend your payment time your monthly amount decreases but the actual total amount you pay is much more than the original principle of $27,550. How much more? Well, consider these numbers:

10 years - $35,049 (27% more than the principle)

15 years - $39,190 (30% more than the principle)

20 years - $43,600 (58% more than the principle)

I hope this post has helped shed light on objective numbers around student loan debt. I hope you’ll take time to play around with a student loan debt calculator and learn what happens when you change the various inputs. Note that these things are true for any loan. Interest means you will pay more and the longer your extend it out the greater the total will be with everything else held constant.

My next post will dig into Parent PLUS loans, another federal loan type, so you can further understand how these loans contribute to loan debt and whether they are a good idea for your family.

Have a question or comment? Please leave it in the comment section below or contact me at mark@mastalskicoaching.com.

There’s no one way to do college.

Be Boundless.