Subsidized and unsubsidized federal direct loans.

Cash for college.

There are more than 4,000 post-secondary institutions (community colleges, four-year public universities, four-year privates) in the United States. One thing they all have in common is that they are enrolled with the Department of Education in order to offer Title IV funding, known as financial aid to most students and families. Title IV refers to a section of the Higher Education Act (HEA) passed in 1965, which authorizes which higher education institutions can offer certain types of federal financial aid. In this post I will discuss a common type of financial aid that many students receive - federal direct loans.

There are currently two different types of federal direct loans - subsidized and unsubsidized. Even though they are both federal loans and offered directly to students, they are different. Understanding their differences can save you thousands of dollars over the life of your loans (typically more than ten years).

The main difference between these two types of loans is how they are structured and who is eligible to receive them. As of this posting on December 30, 2022, the fixed interest rate for any federal direct loan is 4.99%.

Subsidized direct federal loans are need-based loans that are available to undergraduate students who demonstrate financial need. Note that graduate students are NOT eligible for subsidized loans. The main advantage of subsidized loans is that the government pays the interest on the loan while the borrower is in school at least half-time, during the six-month grace period, and during any deferment periods. This means that the borrower does not have to worry about accruing interest while they are in school or during other periods when they are unable to make loan payments. This is a crucial piece about subsidized loans. In terms of loans, subsidized loans are the best you can get. Keep in mind, not every student qualifies for subsidized loans as they are need-based. The maximum amount of subsidized loan for any qualifying first-time, first-year college student is $3,500.

Unsubsidized federal direct loans are not based on financial need. They are available to undergraduate, graduate, and professional students. The main disadvantage of unsubsidized loans is that the borrower (student) is responsible for paying all of the interest that accrues on the loan, even while they are in school. This means that the borrower will have a higher total loan balance to pay off after graduation. In other words, interest on unsubsidized loans will begin accruing from the moment the borrower (student) accepts their loan package through the institution’s financial aid office. This is a key distinction between subsidized loans and unsubsidized loans. The maximum amount of unsubsidized loans any qualifying first-year undergraduate may receive is $5,500 per year (as of this posting).

The main difference between subsidized and unsubsidized direct federal loans is that subsidized loans are need-based and the government pays the interest while the borrower (student) is in school (and during the six month grace period following graduation), while unsubsidized loans are not need-based and the borrower is responsible for paying the interest that accrues on the loan.

But wait, there’s more…

The federal government has established annual and aggregate maximums for all direct federal loans. This means that all qualifying borrowers are limited in the amount of direct loans they can receive in any one year and in aggregate. So how does this all work? The following information lays out annual loan limits and an aggregate limit for qualifying, dependent undergraduate students.

First-year undergraduate limit

$5,500 total - no more than $3,500 may be from subsidized loans

Second-year undergraduate limit

$6,500 total - no more than $4,500 may be from subsidized loans

Third-year and beyond undergraduate limit

$7,500 total - no more than $5,500 may be from subsidized loans

Subsidized and unsubsidized loan aggregate limit

$31,000 - and no more than $23,000 of this may be from subsidized loans

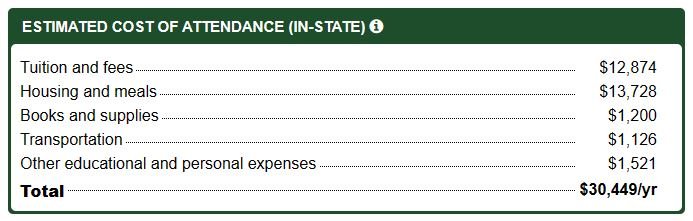

So let’s see how this works in an overall financial aid package. I’m going to use a net price calculator from a public university in Colorado. Net price calculators can be found for any school by simply searching for “net price calculator <name of school>”. (Pro-tip: you should check this out for any school you are interested in.) Using the net price calculator, the school provided me with the following cost of attendance breakdown:

So according to this institution, I should know that the estimated cost of attendance is $30,449/year for the first year. Note that this is an estimate and the actual bill will be different due to indirect costs such as books and supplies, transportation, and other expenses. But this is a great place to start in order to understand what the list price may be for the first year.

The net price calculator also provided me with financial aid estimates based on a limited number of inputs I provided (family size, income, number of students in college, etc). Accordingly, the loan package breakdown I received is:

Note that this loan package, estimated from the inputs I provided into the net cost calculator, informs me that I may be eligible for the maximum amounts of subsidized loans ($3,500) and unsubsidized loans ($2,000) as I am a first-year undergraduate student and I meet their definition of having financial need. Remember that this isn’t set in stone as I would not know my actual loan situation until I receive a financial aid package from the institution.

So, you may now be asking “What is that $9,449 Parent PLUS loan”? So glad you asked as I’ll be covering that in my next blog post.

There’s no one way to do college and there’s no one best college. I offer different services and resources to not only find the RIGHT school but also how to be SUCCESSFUL in your college experience and beyond. Please don’t hesitate to reach out to me for more information. Be Boundless.